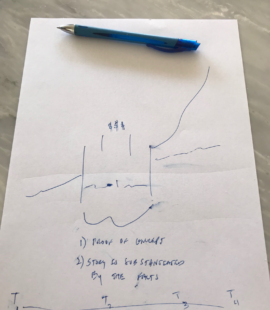

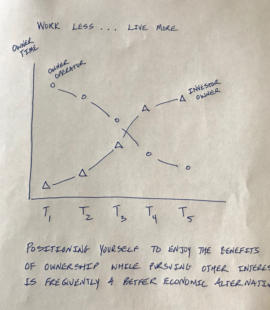

The Magic Window

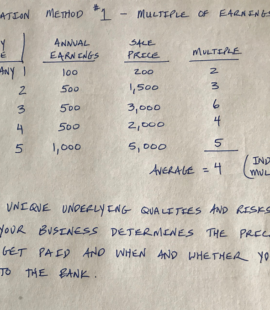

I was visiting with a business owner and friend this afternoon. His business is growing. He has been approached by buyers. He recognizes his personal strengths lie in the early stage and early growth period. He knows the current business “has legs.” He has additional ideas for new businesses. I drew this picture of the Magic Window, the phase where … Read More