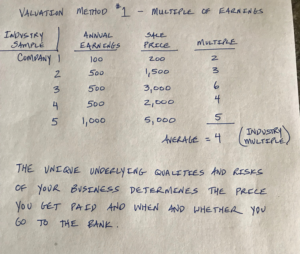

One of the most common methods investment bankers and business brokers use to value companies is called the multiple of earnings approach. They use past transaction data to arrive at a composite average “multiple” that they apply to businesses with similar revenue and earnings.

Digging just below the surface, business owners should re-think the reliance they place on this method. It may not be the right one for the most important economic transaction of their lifetime.

Here are just a few questions that warrant further conversation:

1) Will owners with businesses that are similar to companies 1 & 2 sell for four times earnings if they allow a broker to “take them to market” on the basis of a multiple of earnings valuation?

2) What made the difference in the outcome for the owners of companies 2, 3 & 4? Each company had similar earnings.

3) If the post-sale lifestyle needs of the owner of company 5, only required a $4,000,000 sale, would they have realized a $5,000,000 transaction?

These and other hard questions deserve an owners thoughtful consideration.

In a separate post, the economic interests of brokers and how they do; or, don’t, align with the owners they are representing will be highlighted.